Zomato’s Stock Plunge: Can It Make a Comeback?

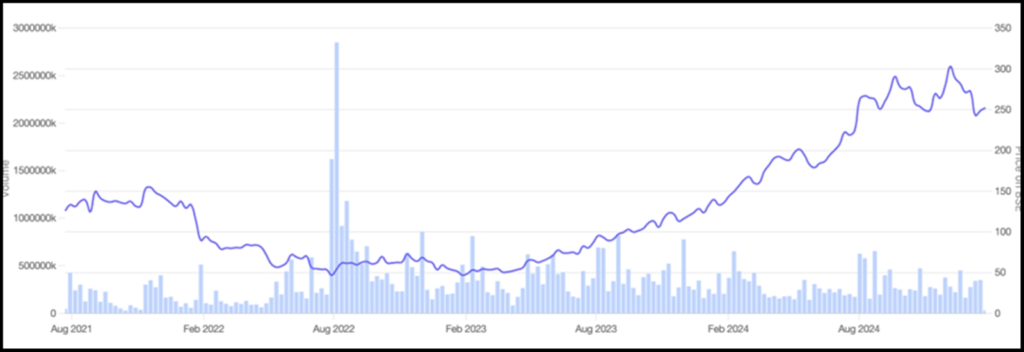

Zomato, one of India’s leading food-tech giants, has seen its stock tumble 30% from its peak, cutting its one-year return to 60%. This sharp decline has sparked concerns over its ambitious growth narrative. Is this a short-term correction for a high-growth company, or are there cracks in its broader strategy? To answer this, we must dissect Zomato’s business model, growth trajectory, and potential challenges.

Zomato’s Business Model: A Multi-Course Strategy

Zomato operates in multiple verticals, each catering to India’s evolving consumer landscape:

- Food Delivery: The core of Z

- Quick Commerce (Blinkit): omato’s business, contributing significantly to its revenue.A rapid-growing segment focusing on grocery and essentials delivered within minutes.

- Restaurant Listings & Advertising: A supplementary revenue stream via partner restaurants.

- Hyperlocal Deliveries & New Ventures: Expansion into newer markets such as corporate snack solutions (Bistro by Blinkit) and ultra-fast restaurant deliveries.

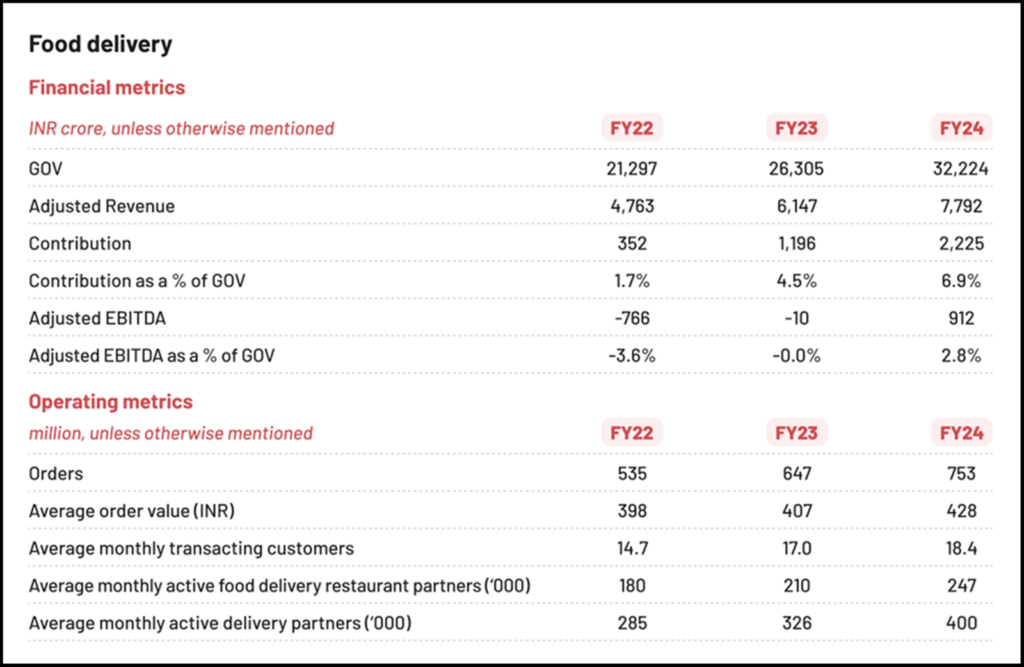

The Food Delivery Landscape: Dominating Market Share

Zomato currently holds a 55% market share in India’s food delivery space, compared to Swiggy’s 42%. Despite its lead, competition remains fierce. However, food delivery growth remains steady, expanding at a 20% YoY rate. Zomato’s Gross Order Value (GOV) grew by 20% between FY24 and FY25, with adjusted revenues following a similar trend. This underscores the segment’s robustness, even as newer verticals contribute more to Zomato’s topline.

Profitability and Margins: The Shift to Sustained Gains

One of the biggest concerns for food delivery startups has been achieving profitability. However, Zomato’s food delivery business has transitioned from aggressive expansion to sustained profitability:

- Adjusted EBITDA grew 128% YoY to ₹285 crore in Q3FY25.

- EBITDA margin increased to 4.3%, up from 3.0% a year ago.

- Platform fee optimization & cost efficiencies have boosted margins.

- Expected stabilization at 5% EBITDA margins in the next few quarters.

Innovations Driving Growth

Zomato is not just relying on traditional food delivery but is introducing innovations to enhance customer experience:

- Quick restaurant delivery: Delivering select menu items in under 15 minutes using optimized fleets.

- Bistro by Blinkit: Targeting corporate offices with quick snacks, beverages, and meal solutions. These initiatives showcase Zomato’s adaptability and willingness to explore untapped markets.

Can a New Competitor Break In?

Highly unlikely. Here’s why:

- Steep Capital Barriers: Over ₹56,000 crore ($7 billion) has been invested in food delivery, primarily by Zomato and Swiggy.

- Network Effects: With over 300,000+ restaurants and 200,000+ delivery partners, Zomato has built a strong competitive moat.

- Customer Loyalty: Programs like Zomato Gold ensure customer stickiness, making it hard for new entrants to lure users away.

Future Growth: Expanding Beyond Metros

The Indian food delivery market, currently valued at ₹60,000 crore (FY24), is expected to hit ₹2 lakh crore by 2030, growing at 20% CAGR. If Zomato maintains its market share, it could generate ₹27,000 crore in revenue by 2030, with EBITDA potentially scaling 10x to ₹5,500 crore. Can Zomato bounce back after a 30% stock plunge? The key growth drivers include:

- Tier-2 & Tier-3 Expansion: Unlocking new demand while managing delivery costs.

- Higher Average Order Values (AOVs): Increasing order sizes and premiumization.

- Operational Efficiencies: Streamlining logistics and delivery infrastructure.

Zomato stock analysis: After a 30% plunge, can Zomato recover? Explore its business model, growth potential, and future strategies in this in-depth analysis.

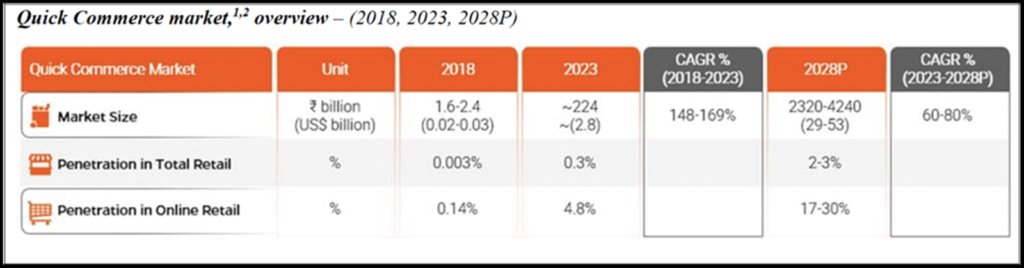

Zomato Blinkit: The Q-Commerce Giant

Zomato’s quick commerce segment, led by Blinkit, has redefined India’s grocery and essentials market. Traditional e-commerce struggles with long delivery times, but Blinkit’s model prioritizes hyperlocal fulfillment with instant delivery. With aggressive scaling, Blinkit could become a major growth pillar for Zomato.

Conclusion: Can Zomato Bounce Back?

Despite the recent 30% stock plunge, Zomato’s fundamentals remain strong. The company is profitable, expanding into new markets, and optimizing costs. While short-term corrections are expected in high-growth stocks, Zomato’s long-term prospects remain bullish. Investors need to evaluate whether this is a temporary setback or an opportunity to enter at lower levels.

One thing is certain—Zomato’s journey is far from over, and the coming years will determine if it can reclaim its peak valuations or if challenges will slow down its momentum.

FAQs

1. Why did Zomato’s stock price drop by 30%?

The stock price fell due to market corrections, concerns over profitability, and investor sentiment shifts. However, Zomato’s core business remains strong.

2. Is Zomato still a good investment?

Despite short-term fluctuations, Zomato continues to show strong revenue growth, market leadership, and profitability improvements, making it a long-term prospect.

3. How does Zomato compare to Swiggy?

Zomato currently holds a 55% market share, leading Swiggy’s 42%, giving it a competitive edge in the food delivery space.

4. What is Blinkit, and why is it important for Zomato?

Blinkit is Zomato’s quick commerce vertical, delivering groceries and essentials within minutes. It is a high-growth segment that diversifies revenue streams.

5. What are the future growth prospects for Zomato?

Expansion into Tier-2 and Tier-3 cities, increasing AOVs, and improving operational efficiencies are expected to drive growth and profitability in the coming years.