GST Two-Tier Tax Structure 2025: A Game-Changing Reform for Common Citizens

The GST Two-Tier Tax Structure 2025 marks a major milestone in India’s indirect taxation system. The GST Council, in its 56th meeting held on September 3, 2025, approved a simplified two-slab structure of 5% and 18%, replacing the multiple-rate system that existed earlier.

Google Gemini Student Offer: Official Guide to 15 Months Free AI Access

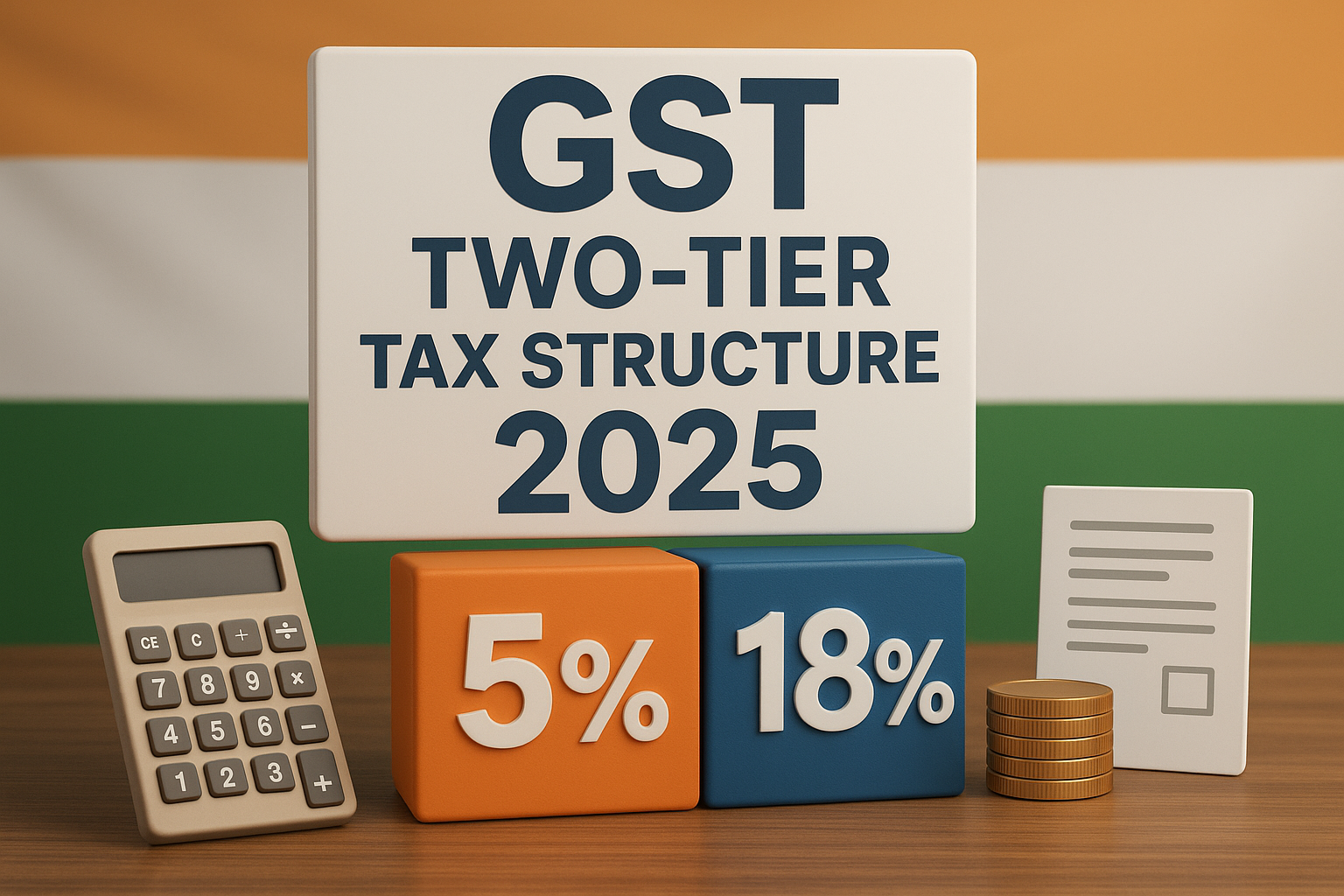

Prime Minister Narendra Modi welcomed this historic step, recalling his Independence Day assurance of introducing next-generation reforms in GST. Finance Minister Nirmala Sitharaman emphasized that the GST Two-Tier Tax Structure 2025 has been designed with the common man, farmers, and small industries in mind.

Why GST Two-Tier Tax Structure 2025 Matters

Union Budget 2025: Date, Time, and Key Highlights of FM Nirmala Sitharaman’s Budget Presentation

- It simplifies GST by reducing the number of slabs.

- It lowers taxes on daily-use essentials.

- It gives relief to labour-intensive industries.

- It supports farmers, healthcare, and the agriculture sector.

- It boosts economic drivers while keeping luxury and sin goods under higher taxation.

Updated GST Rates Under the Two-Tier System

The GST Two-Tier Tax Structure 2025 has brought significant rate revisions across essential and lifestyle products. Neno Banana AI: भविष्य को बेहतर बनाने वाला Positive बदलाव

| Category | Revised GST Rate | Earlier Rate |

|---|---|---|

| UHT Milk | 0% | 5% |

| Condensed Milk, Butter, Ghee, Paneer, Cheese | 5% / Nil | 12% |

| Pasta, Biscuits, Chocolates, Cocoa Products | 5% | 12–18% |

| Dry Fruits & Nuts (Almonds, Cashews, Dates, etc.) | 5% | 12% |

| Refined Sugar, Toffees, Candy | 5% | Higher slab |

| Vegetable Oils, Meat Preparations, Fish Products | 5% | 12–18% |

| Namkeens, Bhujia, Mixture, Chabena | 5% | 18% |

| Mineral Water & Aerated Water (without sugar/flavour) | 5% | 18% |

| Fertilisers | 5% | 12–18% |

| Seeds & Crop Nutrients | 5% | 12% |

| Life-Saving Drugs, Medical Devices | 5% / Nil | 12–18% |

| Electrical Appliances (Entry-Level) | 18% | 28% |

| Footwear & Textiles (Mass-market) | 5% | 12% |

Items Remaining Under Higher Taxation

The GST Two-Tier Tax Structure 2025 continues to impose higher rates on luxury and sin goods:

New Income Tax Bill 2025: Simplified Tax Laws & Key Updates

- Pan masala, gutkha, cigarettes, tobacco products → Existing high rates + Compensation Cess

- Aerated waters with added sugar/sweeteners/flavouring → 40% (earlier 28%)

- Sin & luxury goods (premium liquor, high-end cars, imported armoured sedans) → 40%

Additionally, the valuation of pan masala and tobacco products has been shifted from transaction value to Retail Sale Price (RSP) for better compliance.

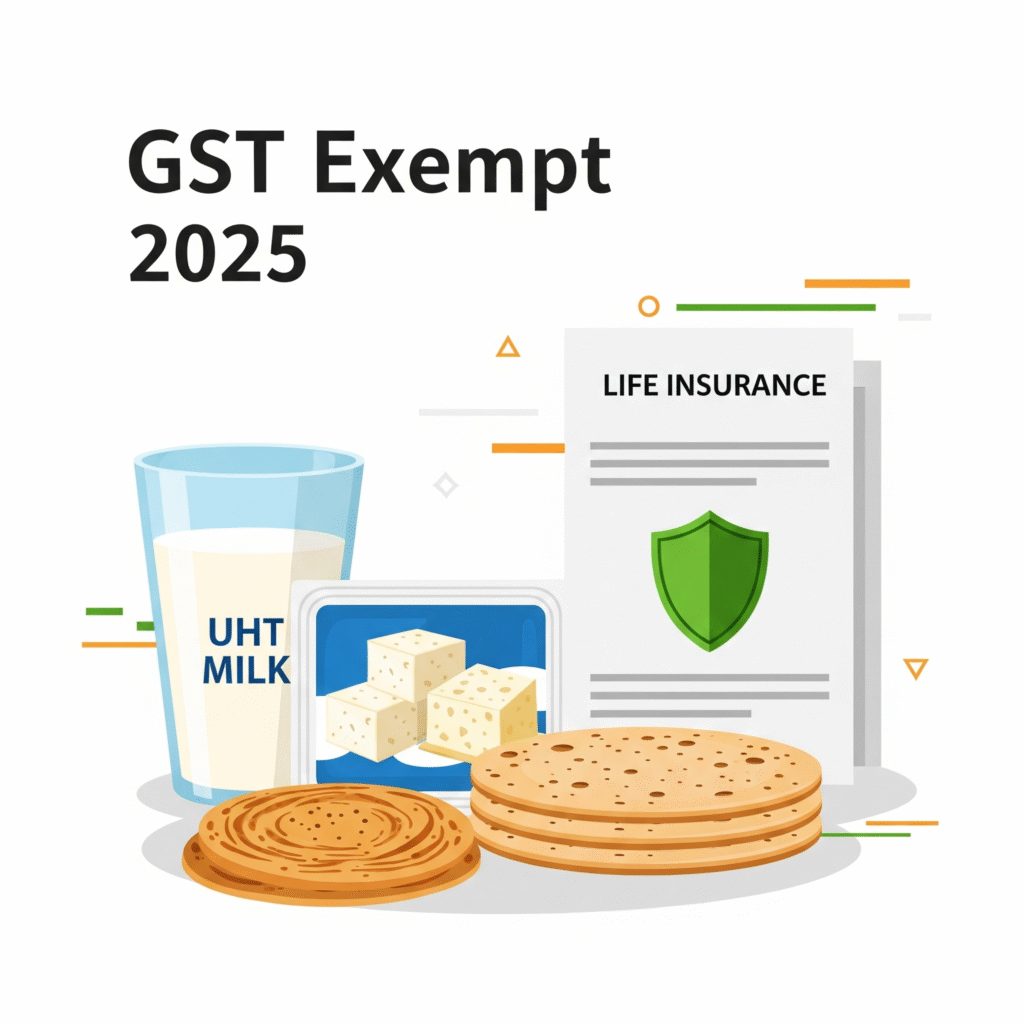

GST Exemptions Under the New Structure

The GST Two-Tier Tax Structure 2025 also brings relief through exemptions:

- UHT milk

- Prepackaged paneer/chena

- All Indian breads (roti, chapati, paratha, parotta, etc.)

- Individual life insurance policies (term, ULIP, endowment) and reinsurance

Impact of GST Two-Tier Tax Structure 2025

- Households: Daily essentials like milk, biscuits, namkeens, and packaged foods become cheaper.

- Farmers: Lower taxes on seeds, fertilizers, and agriculture inputs.

- Healthcare: Life-saving drugs and medical devices made more affordable.

- Industries: Reduced tax burden on textiles, footwear, and entry-level appliances.

- Economy: Simplification encourages compliance and strengthens revenue flow.

Conclusion

The GST Two-Tier Tax Structure 2025 is a bold reform that simplifies India’s indirect taxation, reduces the burden on common citizens, and boosts industries. By rationalizing tax rates into just two slabs—5% and 18%—the government has paved the way for a transparent, people-friendly, and growth-oriented GST regime.